Loading.....

Strategic Approach to Build Custom RegTech Solution

In a world where regulatory complexities constantly challenge businesses, the emergence of Regulatory Technology, or RegTech, is nothing short of a game-changer. Picture RegTech as a trusty ally, blending "Regulatory" and "Technology" to empower organizations in navigating the intricate maze of compliance. Think of it as a digital sherpa, guiding financial institutions through the dynamic landscape of ever-evolving regulations.

It's the friend you didn't know you needed—the one who streamlines processes reduces costs and ensures adherence to the ever-changing regulatory symphony. So, let's dig in and unravel the world of RegTech and its profound influence on making sure everything stays compliant.

What is RegTech?

RegTech is a portmanteau of "Regulatory" and "Technology," encapsulating a broad spectrum of technological solutions designed to streamline and enhance regulatory compliance processes within the financial industry. Its primary goal is to help organizations navigate the complex web of regulations, reduce compliance costs, and ensure adherence to ever-changing regulatory frameworks.

Traditional approaches to compliance were proving to be inefficient and costly, prompting financial institutions to seek innovative solutions. This gave rise to a new wave of technology-driven tools and platforms specifically tailored to address regulatory challenges.

Key Functionalities of RegTech

- Automation of Compliance Processes

- Data Management and Analytics

- Risk Management

- KYC (Know Your Customer) Compliance

- AML (Anti-Money Laundering) Compliance

- Blockchain Technology in RegTech

Benefits of RegTech

- Cost Reduction: Traditional compliance processes are resource-intensive and can lead to significant financial burdens. RegTech streamlines these processes, resulting in substantial cost savings for financial institutions by reducing the need for manual intervention.

- Enhanced Accuracy and Timeliness: Automation and real-time data analysis inherent in RegTech solutions enhance the accuracy and timeliness of compliance reporting. This, in turn, helps organizations stay ahead of regulatory deadlines and avoid penalties.

- Adaptability to Regulatory Changes: The regulatory landscape is dynamic, with laws and requirements evolving continuously. RegTech solutions are designed to adapt swiftly to these changes, ensuring that financial institutions remain compliant with the latest regulatory standards.

- Improved Risk Management: RegTech's ability to analyze data in real-time enables organizations to identify and address potential risks promptly. This proactive approach to risk management minimizes the likelihood of regulatory breaches and enhances overall organizational resilience.

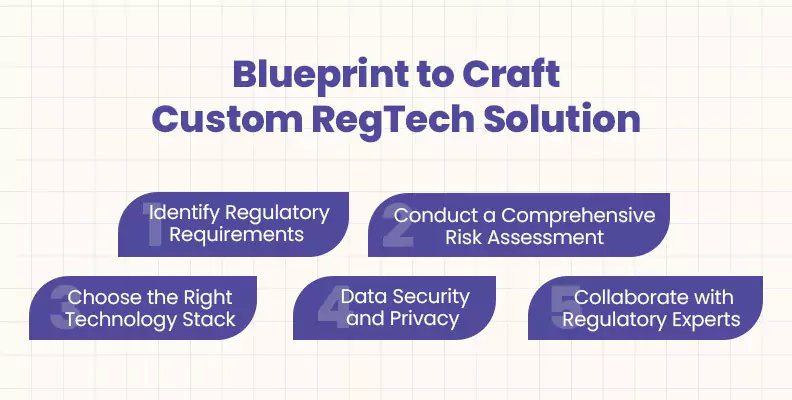

Blueprint to Craft Custom RegTech Solution

For businesses seeking a tailored approach to regulatory compliance, developing a custom Regulatory Technology (RegTech) solution is the key to navigating the complex landscape efficiently.

Here are the essential steps to build a custom RegTech solution that meets your organization's specific needs.

-

Step 1: Identify Regulatory Requirements:

The first step in building a custom RegTech solution is to identify and understand the specific regulatory requirements relevant to your industry and region. Conduct a comprehensive assessment to determine the scope and depth of compliance needed. This step lays the foundation for developing a solution that addresses your organization's unique challenges.

-

Step 2: Conduct a Comprehensive Risk Assessment

Perform a thorough risk assessment to understand potential compliance gaps and vulnerabilities. This step helps prioritize features and functionalities in your custom RegTech solution, ensuring it addresses the most critical regulatory risks your business may encounter.

-

Step 3: Choose the Right Technology Stack

Selecting an appropriate technology stack is crucial for the success of your RegTech solution. Consider factors such as scalability, security, and compatibility with existing systems. Cloud-based solutions are often preferred for their flexibility and ease of integration with other tools.

-

Step 4: Data Security and Privacy

Given the sensitive nature of regulatory data, prioritizing security and privacy is paramount. Implement robust encryption protocols, access controls, and regular security audits to safeguard against potential breaches. Compliance with data protection regulations is not only a legal requirement but also a crucial element in building trust with clients and stakeholders.

-

Step 5: Collaborate with Regulatory Experts

Engage with regulatory experts and legal professionals to gain insights into the nuances of compliance. Building a RegTech solution in collaboration with experts ensures that it stays up-to-date with the latest regulatory changes, reducing the risk of non-compliance. Regular consultations also provide valuable perspectives on emerging trends and technologies in the regulatory landscape.

-

Step 6: User-Friendly Interface

A user-friendly interface is essential for the successful adoption of your custom RegTech solution. Design an intuitive and easy-to-navigate interface that allows users to interact seamlessly with the platform. User training and support should also be considered to ensure a smooth transition and optimal utilization of the solution.

-

Step7: Continuous Monitoring and Updates

Regulatory requirements are dynamic and subject to change. Implement a system for continuous monitoring of regulatory updates and changes. Regularly update your RegTech solution to reflect these modifications, ensuring that your organization remains in compliance with the latest regulations

-

Step 8: Ongoing Testing and Validation

Implement a robust testing and validation process throughout the development and deployment stages of your RegTech solution. Regularly test the functionalities to ensure they align with the identified regulatory requirements. This step helps identify and rectify any potential issues, ensuring the accuracy and effectiveness of your solution. Continuous testing also aids in maintaining a high level of performance and reliability as the regulatory landscape evolves.

Planning to Build a Custom RegTech Solution? Connect with Our Technology Experts for a Free Consultation.

Top 3 Real-Life RegTech Innovations

-

Alyne

Alyne is a RegTech platform that stands out for its comprehensive approach to compliance management. Offering a range of modules, Alyne covers areas such as risk management, cybersecurity, and regulatory compliance. Its user-friendly interface and customizable features make it a favorite among businesses of all sizes. Alyne utilizes advanced technology like Artificial Intelligence (AI) and Machine Learning (ML) to automate compliance processes, ensuring real-time monitoring and reporting. This not only saves time but also reduces the risk of human error, providing a robust solution for companies navigating complex regulatory environments.

-

ClauseMatch

ClauseMatch is a RegTech platform specifically designed to streamline document management and enhance compliance processes. It excels in creating a centralized hub for all regulatory documents, making it easier for businesses to stay updated with the latest changes. The platform employs smart workflow automation, allowing teams to collaborate seamlessly on document creation, review, and approval. One of ClauseMatch's notable features is its ability to maintain an audit trail for every document, ensuring transparency and traceability. This proves invaluable during regulatory audits, as businesses can effortlessly demonstrate their compliance journey.

-

ComplyAdvantage

ComplyAdvantage focuses on revolutionizing Anti-Money Laundering (AML) and Know Your Customer (KYC) processes through advanced data analytics and artificial intelligence. The platform offers real-time screening and monitoring of customer data against global sanctions lists, making it an essential tool for financial institutions and businesses susceptible to money laundering risks. ComplyAdvantage's adaptive technology evolves with regulatory changes, providing a dynamic solution that anticipates and addresses emerging compliance challenges. This not only enhances the efficiency of AML processes but also ensures that businesses are well-equipped to combat financial crimes.

Conclusion

In conclusion, RegTech represents a pivotal advancement in the financial industry, revolutionizing the way organizations approach regulatory compliance. By harnessing the power of technology, financial institutions can not only meet regulatory requirements more efficiently but also gain a competitive edge in an increasingly complex and fast-paced environment. As the regulatory landscape continues to evolve, embracing RegTech becomes imperative for those seeking to navigate the intricate web of compliance with agility and precision.

Back to blog

Back to blog